Your Ultimate Guide to IVF Clinics in San Diego: Everything You Need to Know

April 29, 2025

Finding the Best IVF Clinic in NYC: Your Ultimate Guide to Starting a Family

April 29, 2025IVF Cost with Insurance: Everything You Need to Know Before Starting Your Journey

Starting a family can feel like a rollercoaster ride—exciting, nerve-wracking, and sometimes expensive. If you’re considering in vitro fertilization (IVF), you’re probably wondering: How much will this cost me, and will my insurance help? You’re not alone! IVF is a hot topic for many hopeful parents, and the price tag—along with insurance coverage—can be a big mystery. Don’t worry, though; we’re here to break it all down for you in a way that’s easy to understand, with some surprising twists and insider tips you won’t find just anywhere.

In this article, we’ll dive deep into the world of IVF costs with insurance. We’ll uncover hidden expenses, share real-life examples, and give you practical advice to save money and stress. Plus, we’ll sprinkle in some fun facts and fresh research to keep things interesting. Whether you’re just curious or ready to take the plunge, this guide has everything you need to feel confident about your next steps.

![]()

What Does IVF Really Cost? The Numbers Might Surprise You

IVF isn’t cheap—let’s get that out of the way. But the actual cost depends on a lot of factors, like where you live, your clinic, and what extras you need. Without insurance, a single IVF cycle (that’s one round of treatment) can range from $12,000 to $25,000. Add in medications, and you might be looking at another $3,000 to $5,000. That’s a big chunk of change—enough to buy a decent used car or take a dream vacation!

Breaking Down the Basics

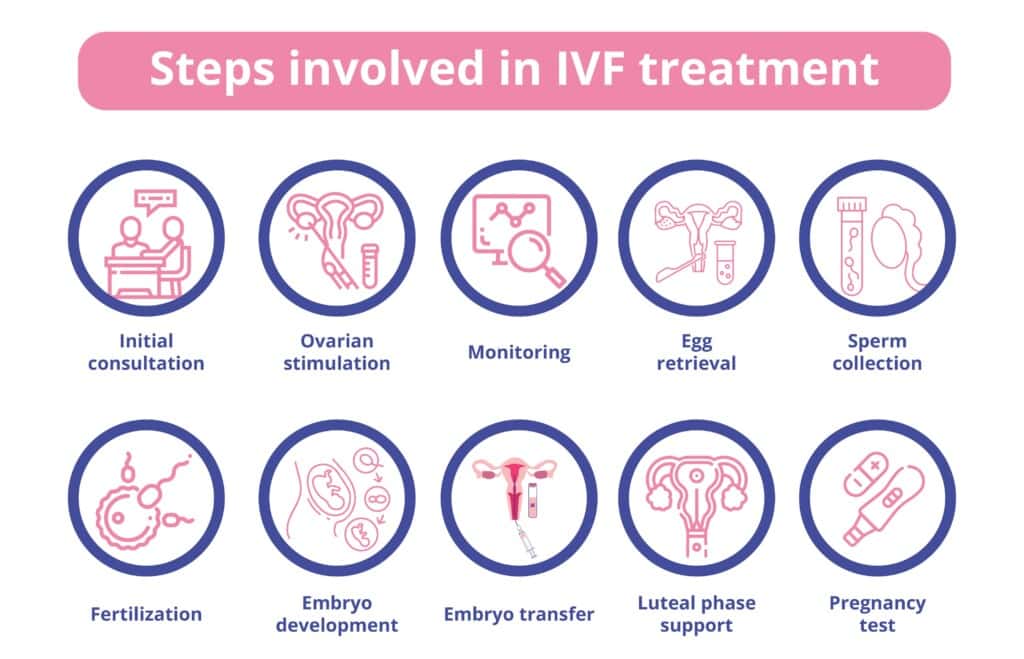

Here’s what you’re typically paying for in an IVF cycle:

- Egg retrieval: The doctor takes eggs from your ovaries (about $5,000-$10,000).

- Fertilization: Eggs meet sperm in a lab to create embryos ($1,000-$3,000).

- Embryo transfer: Placing the embryo in your uterus ($1,000-$3,000).

- Medications: Hormones to help your body produce eggs ($3,000-$5,000).

- Monitoring: Ultrasounds and blood tests to check progress ($1,500-$3,000).

The Hidden Costs People Don’t Talk About

A lot of folks don’t realize there’s more to the bill than just the procedure. These sneaky extras can add up fast:

- Genetic testing: Checking embryos for health issues (called PGT) can cost $1,500-$3,000.

- Freezing embryos: Saving extras for later? That’s $500-$1,000 upfront, plus $300-$600 a year for storage.

- Travel: If your clinic’s far away, gas, flights, or hotels pile on expenses.

- Time off work: Missing days for appointments or recovery? That’s lost income.

Fun fact: Did you know some couples spend more on IVF than their wedding? One study found the average wedding costs $20,000—right in the ballpark of a single IVF cycle!

Does Location Matter?

Yes! IVF costs vary wildly by state. In New York City, a cycle might hit $20,000, while in a smaller town, it could be closer to $12,000. Why? Big cities have higher clinic fees and more demand. So, if you’re near a rural area, you might save a little cash—just watch out for travel costs if you need a top-notch specialist.

Quick Tip: Call clinics in your area and ask for a price breakdown. Some even offer free consultations—score!

How Insurance Changes the Game

Here’s the million-dollar question: Will my insurance cover IVF? The answer is… it depends. Insurance can slash your out-of-pocket costs, but it’s not a golden ticket. Only about 25% of Americans with employer-sponsored insurance get IVF coverage, according to a 2024 KFF report. Let’s unpack how this works.

What “Covered” Really Means

When insurance says IVF is “covered,” it doesn’t mean free. You’ll still have to deal with:

- Deductibles: The amount you pay before insurance kicks in (e.g., $500-$2,000).

- Co-insurance: You pay a percentage of the cost (like 20%), and insurance covers the rest.

- Out-of-pocket max: The most you’ll pay in a year (could be $2,000-$6,000).

For example, if your IVF cycle costs $20,000 and you have a $1,000 deductible with 20% co-insurance, you’d pay:

- $1,000 (deductible) + $3,800 (20% of the remaining $19,000) = $4,800 out of pocket. Not bad compared to $20,000!

States That Make Insurance Pay

Some states have laws forcing insurance to cover IVF—pretty cool, right? As of 2025, 20 states have fertility mandates, and 14 include IVF. Here’s a quick list:

- Full IVF coverage: New York, Connecticut, Illinois

- Partial coverage: California, Texas, New Jersey

- No mandate: Florida, Alabama, Idaho

If you live in a mandate state, check your plan—small companies or self-insured employers might be exempt. Dr. Jane Frederick, a fertility expert in California, says, “State laws are a game-changer, but loopholes still leave many patients footing the bill.”

The Catch with Employer Plans

Big companies like Google or Starbucks sometimes offer IVF benefits—up to $20,000 or more! But smaller employers? Not so much. If your job doesn’t cover it, you’re stuck with whatever your private insurance offers—or paying full price.

Action Step: Ask your HR department if IVF’s included. You might be surprised—some add it as a perk to attract workers!

Real Stories: What IVF Costs With Insurance Looked Like for Them

Numbers are great, but stories hit home. Let’s meet three people who’ve been there.

Sarah’s Success in New York

Sarah, a 32-year-old teacher, lives in New York, where IVF coverage is mandatory. Her insurance covered 80% after a $500 deductible. Her $18,000 cycle cost her $4,100 out of pocket. “I was shocked at how much I still paid,” she says, “but it beat $18,000!” Bonus: She’s now mom to a 1-year-old.

Mike’s Struggle in Florida

Mike, 38, from Florida, wasn’t so lucky—no state mandate. His insurance covered diagnostics ($2,000), but IVF? Zero. He paid $22,000 cash, plus $4,000 for meds. “We drained our savings,” he admits. “It worked, but man, it stung.”

Lisa’s Corporate Win

Lisa, 29, works for a tech company with IVF benefits. They covered $15,000 of her $20,000 cycle. She paid $5,000, mostly for meds and freezing embryos. “I felt like I won the lottery,” she laughs. Her twins arrived last summer.

These stories show how insurance—or lack of it—shapes the IVF journey. Where do you fall?

Sneaky Insurance Tricks to Watch Out For

Insurance can feel like a maze. Here are traps to avoid and hacks to try.

The “Not Medically Necessary” Excuse

Some plans only cover IVF if you’ve tried cheaper options (like IUI) first—or if you’ve been trying to conceive for a year. If they say “not necessary,” appeal it! Gather doctor notes to prove it’s your best shot.

Out-of-Network Nightmares

Picking a clinic your insurance doesn’t cover can double your costs. One couple thought their doctor was in-network, only to get a $10,000 bill because the lab wasn’t. Always double-check every provider—clinic, lab, even the anesthesiologist.

Medication Loopholes

Meds are a gray area. Some plans cover them; others don’t. If yours doesn’t, ask your clinic about discount programs like Compassionate Care—they can cut costs by 25%-75%.

Pro Hack: Use GoodRx to compare med prices at local pharmacies. You might save hundreds!

How to Slash IVF Costs Even With Insurance

Insurance helps, but you can still save more. Here’s how.

Shop Around for Clinics

Prices vary, even with insurance. Call multiple clinics and ask:

- What’s your base IVF cost?

- Any package deals (e.g., multi-cycle discounts)?

- Do you work with my insurance?

One clinic might charge $15,000, while another’s $12,000—same quality, different price.

Look Into Mini or Natural IVF

- Mini IVF: Uses less medication, cutting costs to $5,000-$7,000 per cycle. Fewer eggs, but gentler on your body.

- Natural IVF: No meds, just your natural cycle—around $3,000-$6,000. Best for younger women with good egg reserves.

A 2023 study in Fertility and Sterility found mini IVF success rates rival traditional IVF for some patients—worth asking your doctor about!

Tap Into Grants and Loans

- IVF Grants: Groups like BabyQuest offer up to $15,000. Apply early—spots fill fast.

- Fertility Loans: Companies like ARC Fertility provide low-interest options. Monthly payments beat a huge lump sum.

Checklist:

✔️ Research 3 clinics near you.

✔️ Check grant deadlines.

❌ Don’t assume your first quote’s the best deal.

Latest Research: What’s New in IVF Costs and Coverage?

Science is always moving, and it’s shaking up IVF costs. Here’s the scoop from 2024-2025.

AI Could Lower Costs

Clinics are testing AI to pick the best embryos, cutting down on failed cycles. A 2024 study from Stanford showed AI boosted success rates by 15%. Fewer cycles = less money spent. It’s not everywhere yet, but ask if your clinic’s jumping on this trend.

Insurance Pushback

Politicians are debating federal IVF coverage mandates. If passed, it could force all plans to cover it—but critics say premiums might rise. Dr. Mark Hornstein, a Boston fertility specialist, warns, “Universal coverage sounds great, but the cost could trickle down to everyone.”

Success Rates vs. Cost

New data shows women under 35 have a 50% live birth rate per cycle, dropping to 20% over 40. Older patients might need 2-3 cycles, hiking costs even with insurance. Plan ahead based on your age!

Your Step-by-Step Guide to Navigating IVF Costs With Insurance

Ready to start? Here’s a roadmap to keep costs in check.

Step 1: Decode Your Insurance

- Call your provider.

- Ask: “Do you cover IVF? What’s my deductible, co-insurance, and max out-of-pocket?”

- Get it in writing—verbal promises don’t hold up.

Step 2: Pick the Right Clinic

- Choose an in-network provider.

- Compare success rates on SART.org (Society for Assisted Reproductive Technology).

- Book a consult—many are free.

Step 3: Budget for Extras

- Save $5,000-$10,000 for meds, travel, and surprises.

- Set up a payment plan if needed.

Step 4: Maximize Savings

- Apply for grants or discounts.

- Use an HSA/FSA if you have one—tax-free money for IVF!

Timeline Tip: Start planning 3-6 months ahead. Insurance approvals can take weeks.

Fun Facts and Myths About IVF Costs

Let’s lighten things up with some trivia and bust a few myths.

Did You Know?

- The first IVF baby, Louise Brown, was born in 1978—and it cost her parents nothing (thanks to research funding)!

- Some clinics offer “IVF vacations” abroad, blending treatment with a getaway for less than U.S. prices.

Myth Busters

- Myth: Insurance always covers IVF meds. Truth: Only sometimes—check your plan!

- Myth: IVF’s a one-and-done deal. Truth: 60% of couples need multiple cycles, per CDC data.

What No One Tells You: Emotional and Financial Balance

IVF isn’t just about money—it’s a mental marathon. Here’s how to stay sane.

The Emotional Toll

Failed cycles can feel like a punch to the gut. One mom, Jen, shared, “I cried over every bill, wondering if it’d ever work.” Lean on support groups—online ones like Resolve are free and full of folks who get it.

Money Mindset

Dr. Alice Domar, a fertility psychologist, says, “Treat IVF like an investment, not a gamble. Focus on what you can control—research, savings, self-care.” Break costs into chunks so it’s less overwhelming.

Self-Care List:

✔️ Take breaks between cycles.

✔️ Talk to a friend who’s been there.

❌ Don’t obsess over every dollar—it’ll drain you.

Let’s Talk: Your Turn!

IVF costs with insurance can feel like a puzzle, but you’ve got the pieces now. What’s your next move? Drop a comment below—tell us:

- What’s your biggest worry about IVF costs?

- Got a money-saving tip to share?

- Just want to vent? We’re here!

Or, shoot us a question—we’ll dig into it and get back to you. You’re not in this alone—let’s figure it out together!